The Due Diligence Engine That Gives You Visibility & Control

Get complete, structured visibility of a company's vendor obligations — without waiting on the data room, and without trusting the target to know what's buried in their inboxes.

Trusted by Leading Investment Firms

Our customers uncover critical contract insights and save weeks of due diligence time.

What It Does

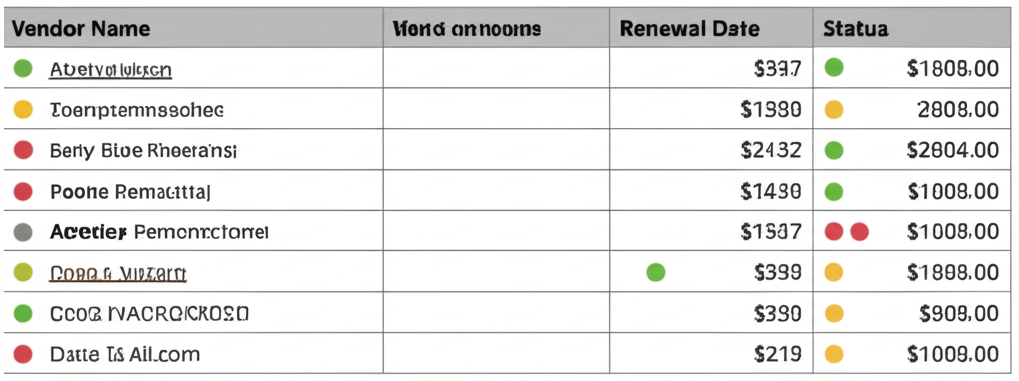

Due Diligence Detective automatically scans employee email inboxes, identifies all attached contracts, and extracts key fields into a structured, exportable table.

You Get:

- Vendor name

- Service description

- Pricing and payment terms

- Renewal and notice periods

- Termination rights

- Start/end dates

- Auto-renewal flags

- Usage volume (e.g., number of seats)

- Responsible department

- Custom deal-specific fields (e.g., SLAs, exclusivity)

Stronger, Deeper Due Diligence in Hours, Not Weeks

Due Diligence Detective gives your deal team an unfair advantage with instant contract intelligence.

Due Diligence Detective uncovers forgotten, expired, redundant, or unbudgeted vendor obligations with no reliance on the target providing clean data.

Due Diligence Detective pulls it all, so you're never exposed post-close to surprise charges or "zombie" subscriptions.

Use Due Diligence Detective to run a post-deal vendor rationalization programme and boost EBITDA in Month 1.

Critical for PE-backed rollups and leveraged buyouts. Understand when spend hits the P&L and how flexible it is to adjust.

Set up compliance triggers post-deal for renewals, audits, or renegotiations to maintain governance.

How It Works

Due Diligence Detective delivers hard contract data in hours, not weeks, with a simple, secure process.

Connect

Connect to target company's Google Workspace or Microsoft Outlook. Our desktop app securely scans inboxes locally.

Scan

Define scope by team, date range, or keywords. Our AI identifies contracts in emails and attachments.

Extract

Our AI extracts 12+ key fields with 95%+ accuracy, including pricing, renewal terms, and custom deal-specific fields.

Analyze

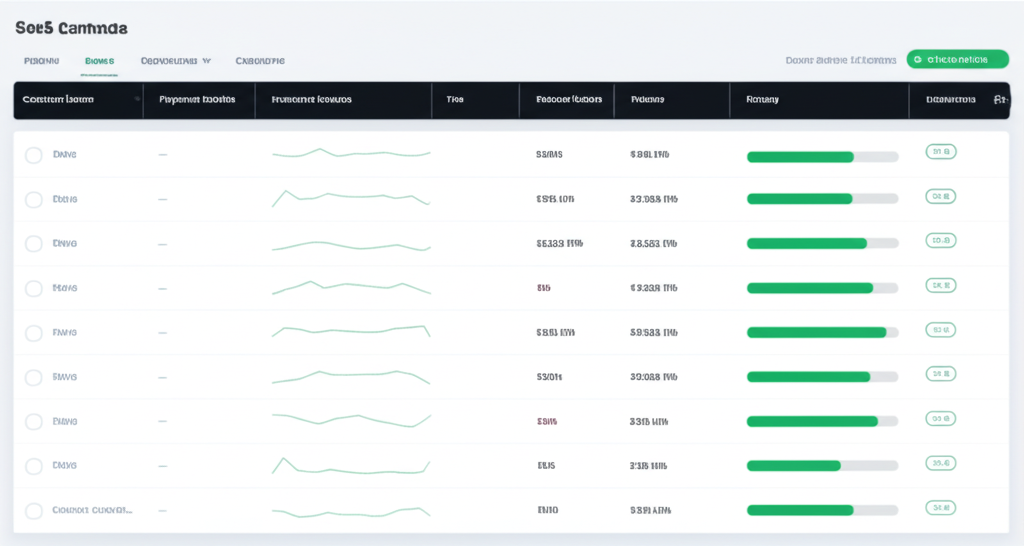

Review structured data in our dashboard or export to CSV for use in models, VDRs, or data rooms.

Advanced Features Built for Due Diligence

Here's how Due Diligence Detective arms your deal team with an unfair advantage:

| Feature | Benefit |

|---|---|

| Bulk Inbox Scanning | Works across 1 or 100+ inboxes. Define scope by team, date, or keyword. |

| High-Accuracy AI Extraction | 95%+ extraction precision. Includes synonyms to reduce false negatives. |

| Custom Field Tagging | Define deal-specific red flag fields (e.g., data terms, exclusivity). |

| Contract De-Duplication | Detect multiple versions of the same agreement. |

| Export to CSV | Instantly usable in models, VDRs, or data rooms. |

| Confidence Scores (roadmap) | Know which contract entries to trust and which to review. |

| Contract Health Check Reports | Auto-generated summaries flag risk or anomalies. |

| Audit Trail Logging (planned) | Track who accessed which contract, when. |

| Email Alert Reports | Daily or weekly digests of new findings or approaching renewals. |

| Post-Close Monitoring | Stay embedded in portcos to monitor spend creep or missed savings. |

Who Uses It

Due Diligence Detective is trusted by investment professionals across the industry.

Investing in AI or SaaS startups with growing vendor complexity

Preparing platform acquisitions or exits

Evaluating tuck-in targets

Preparing for IPO or audit

Why It Wins

Due Diligence Detective delivers unmatched advantages for due diligence teams.

Results in less than 24 hours

Scans historical inboxes, not just file folders

Source of truth comes from communications, not assumptions

Local execution, zero integration, fully private

Can stay in use post-deal to drive EBITDA, compliance, and governance

Trusted by Investment Professionals

Hear from our customers who have transformed their due diligence process.

Due Diligence Detective uncovered $3.2M in hidden vendor obligations that weren't in the data room. The ROI was immediate and substantial, and it completely changed our valuation model.

Sam Dundee

Partner, Hayden Capital

As a PE firm doing 20+ deals a year, we've made Due Diligence Detective standard in our due diligence toolkit. It's saved us from multiple bad deals and helped us identify immediate cost-cutting opportunities post-close.

Alex Park

Managing Director, Netcraft Partners

The implementation was seamless - we were up and running in a day. Now our entire deal team has visibility into every contract, renewal date, and payment term without the manual work.

Michael Chen

VP Investments, TechVenture Capital

Calculate Your Due Diligence ROI

Our customers typically uncover millions in hidden obligations and save weeks of due diligence time.

Based on typical 4% of deal value in undisclosed or forgotten vendor commitments

Value: $0 at $350/hour

Estimated ROI: 0x your investment in Due Diligence Detective

Due Diligence Detective Turns Due Diligence Into a Deal-Making Weapon

You wouldn't run financial due diligence without a QofE. Why would you close a deal without knowing your contract exposure?

Implementation in as little as 24 hours. No credit card required for initial setup.